Govex: The Bull Case

The potential of futarchy.

Table of contents:

1. Introduction

2. The Core Value Proposition

3. Use Cases

4. The End Game

5. Theory Proven

6. MoneynessIntroduction

There are already extensive articles on the potential of futarchy and Govex.

And no doubt there will be many more. This article aims to present only novel and orthogonal ideas.

Futarchy is so counter-intuitive that it seems to trigger cognitive dissonance in all who learn about it for the first time.

What stage are you at?

The Core Value Proposition

Govex offers permissionless markets for decision-making. Good decisions create new value in the world. Futarchic decision markets incentivize good decisions to be presented and actioned. Therefore Govex is the perfect tool for transmutation of wealth-knowledge into wealth.

Futarchy is a self-reinforcing system. Traders who are better at predicting the impact of proposals, over time, gain more influence. No longer do you need to go to the right Ivy League school, the right golf club, the after-work drinks, or kiss ass for 30 years and then be too old and afraid to make change when you finally get power. Write a doc and let the market decide.

Futarchy is about to do to the corporation what Bitcoin did to fiat. A Futarchy is analogous to the CEO, the board of directors, and the public markets in one entity. An entity with millisecond latency root access. This is a brand new company structure, a sort of Dutch East India Company, zero to one moment. The Dutch East India Company was the first publicly traded corporation. Interestingly its market cap went to the high trillions when adjusted for inflation.

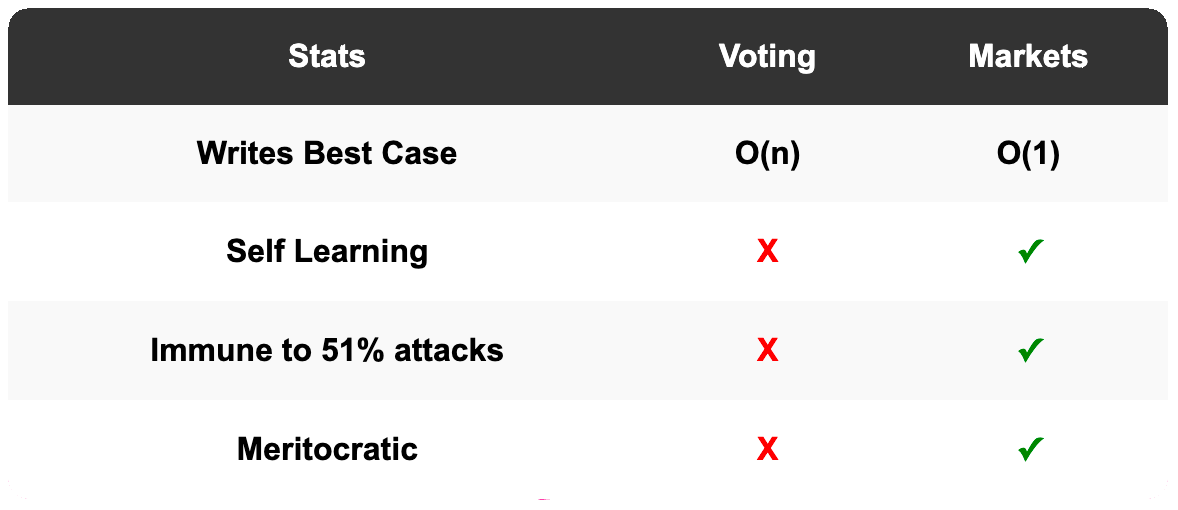

Humans are a eusocial species. Organization and collaboration are everything to us. For thousands of years, we have been using variations of democracy to make key decisions. From a computer science perspective, if we analyze democracy as an algorithm, for a group of N people, N votes are required, or in database terminology, N writes. Any blockchain or database engineer knows that writes are the bottleneck to be optimized. (It's generally good enough for reads to be eventually consistent, so they are cheaper.) We can, therefore, say that democracy has O(N) complexity.

In the best case, with futarchy, if the proposer sets the AMM prices at the right levels, no trading (writes) needs to take place for a decision to pass. It has a best case complexity of O(1). Any software engineer knows no good company will hire you if you use an algorithm with complexity O(N) higher than what is required. I anticipate that, over time, markets will apply discounts to organizations that do not adopt futarchy. This is the founder trade of the next couple of decades.

A table comparing voting and futarchic markets.

Markets facilitate the natural pattern of human coordination. Only a small minority are highly informed and willing to be regularly active. While due to the O(N) cost of voting, votes can only be held sporadically. This creates a stale signal, that for many organizations, can be one to five years out of date. Furthermore, voting assumes there is no useful signal from previous votes. Markets, as Friedrich Hayek famously argued are primarily an information compression and discovery mechanism. The price mutates over time in response to new information and preferences etc.

Like many Futards, I grew up in a Democracy and own some stocks with voting power. I have respect for the rights and opportunities my ancestors bestowed upon me. However, it is not controversial to say, that people of all political colors are increasingly turning away from democracy due to its failures. Let's accelerate. Let's get futarchic.

Use Cases

Social Grace

Futarchy will smooth social interactions and be seen as a social norm for all polite people to follow. Proph3t has said that the futarchic markets offer "blame as a service". Allowing organizations to say "I didn't reject you, the market did". Futarchy decouples action from what people say. Organizations can still have figureheads who spout platitudes. But no one will expect anything of them other than that they care.

Instinctively, we don’t like people who change their minds on important matters.

"What makes him contemptible is being considered changeable…" - Machiavelli

"The wise abhor everything whimsical … especially in matters of state..." - Gracian

However, that clashes with the fundamentally probabilistic nature of the world. Futarchy makes leadership changing their minds, acceptable for the first time in history.

Heterogeneous ETFs

Imagine I have $10 and I want to get exposure to the general returns of the classic whiskey or car market. Onchain each bottle or car can be represented as a hybrid SPL404 NFT. Investors can gain exposure by purchasing the hybrid fungible tokens, without needing to buy an integer number of bottle or car ownership NFTs.

Any amount of money can now track the returns of the entire sector. And even generate a small fee from holding the SPL404 tokens. In contrast to the 0.1% to 0.4% fee holders have to pay to index managers today. This also increases liquidity for borrowing against and getting into and out of positions.

The index will be governed as a futarchy. Investors can buy out of and sell into the ETF. The price of these transactions will be determined by a futarchic market to ensure they mint or burn a fair number of the hybrid tokens in exchange for a given NFT being added to or removed from the index.

The V2 Oracle

If prediction markets are a truth machine that makes Govex an oracle project.

I view a futarchy as a V2 oracle. Futarchies are self-resolving and natural language compatible. Futarchies don't rely on the economic security of external oracle chains. Futarchies are protected by 'proof of positive expected value'. Futarchies can be used to verify the completion of imprecise and unconstrained or hard-to-verify intents or disputes.

Military tech

The rest of this article covers corporate futarchy, however, the following section describes government futarchy.

Famously, the Ethiopian general Haile Selassie once surrounded his enemy while their general was away and had men from his army approach them with baskets of gold to buy all their weapons. The USA used a related tactic in the Afghanistan conflict, enemy combatants were offered payments to surrender weapons through disarmament programs. Imagine for a moment that the USA was run as a futarchy. If China launched an amphibious assault on Taiwan, the markets could quickly deem it +EV (positive expected value) to offer a billion dollars per ship for each captain or crew that ran their cruiser into a reef or sailed away from the battle. Likely only certain actors such as US generals and approved AIs would be permitted to trade in these markets. When decision markets are open, unstoppable, and trustless, bizarre things can happen.

The End Game

Govex currently offers binary and multi-outcome markets. In the future, this will be combined with scalar prediction markets, control flow logic, and mathematical combinators across N-dimensions. The following two figures are attempts to predict some early use cases of the flexibility that such complex proposals will unlock.

Mockup of N-dimensional decision market UI.

Mockup of a control flow proposal.

As stated above markets are an information compression mechanism. Markets compress all information about a company into a single number. Futarchy is an ownership compression mechanism. Futarchy compresses a company's property rights into a single key. Futarchy will unlock the financialization of new types of state. State that was originally isolated in web2 will now be composable, readable, writable, and executable within Turing-complete operations. All state will be governed or encapsulated by the autocrat. All companies will have their assets governed by the autocrat, in an upside-down tree-like hierarchy. To facilitate this the entire web2 SAAS industry will rewrite how their account configs are governed and controlled. AWS, Discord, Google Suite, etc.

A diagram of state encapsulation for Govex and its tenant DAOs.

In the limit, even the text content of an email responding to a novel customer complaint will be fought over by AI agents in the futarchic markets at the Lamport level.

Theory Proven

Many people's core concern when learning about futarchy is its vulnerability to manipulation. Robin Hanson has written about the theory behind futarchy extensively. He has often said that an actor attempting to manipulate the price in decision markets actually incentivizes others to make the price more accurate. This has been decisively proven. The DAO’s price moved rapidly against the manipulator during the two manipulation attacks. See the Pantera and Ben Hawkins cases.

Moneyness

It is becoming evident that crypto is in the 'show me', not 'tell me' phase of its life cycle. The rest of this section will be controversial even among the Govex community.

However, I believe that among all the assets in crypto today $GOVEX has the best chance at gaining some of the elusive moneyness, that is so often talked about in Ethereum circles.

Follow these four premises and decide for yourself.

Fiat in the long term will be replaced, as it regularly has been throughout history.

As Anatoly Yakovenko and Kyle Samani say, commodities like $BTC or $SOL will not gain a monetary premium, but instead will be valued by the DCF of their MEV and SWQOS fees. We will use something like tokenized NASDAQ shares on-chain as money.

One of these three:

A futarchy on the Govex platform is used to govern a ‘futarchic money supply’. It might be an index of equities or other assets governed as a futarchy. It will either be paired against another money, such as USDC or BTC, or an auction will be held, and the outcome with the highest demand for it will be accepted.

OR

Govex's core product, Futarchy as a service (FaaS) becomes a highly customizable, value-added part of the economy with unique network effects connecting companies, proposal traders, and experts. Decision markets are sensitive to small fractions of a percent in price change so organizations are disincentivized to shard their decision market liquidity across multiple layer ones or FaaS applications. FaaS is not entirely commoditized away.

OR

Futarchy enables perfect competition for decision-making. Therefore, Futarchies have a significantly larger Pareto efficient size than legacy companies and are less vulnerable to external creative destruction. They will co-opt and reward good ideas. All companies have their assets owned by the autocrat, in an upside-down tree-like hierarchy. All mergers and acquisitions take seconds to execute. $GOVEX holders are at the center of this and are early in a hyper-consolidation secular trend where futarchic efficiency merges nearly all companies in the economy into one. The wisdom of enantiodromia would indicate that a hyper-competitive capitalist system would resemble a communist central committee.

The Culture

The Govex community has a zeal only matched by AI accelerations and Bitcoiners. To use Balajis’s terminology, futarchy regularly gets to the top of people's identity stack. The R-naught for the Govex strain of Futarchy is particularly high. I speak for many members of Govex when I say, it's not about the token or the money. This is personal. We have had enough of bad governance.

"We can stay futarchic longer than you can stay democratic."